PAN AO Codes - International Taxation List

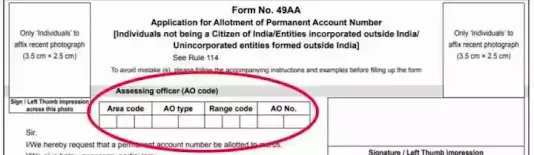

It is mandatory for the applicants to mention the AO code in the PAN application. The AO code under jurisdiction of which the applicant falls, should be selected by the applicant. The applicants are advised to be careful in selection of the AO code. The details given here are as per the information received from the Income Tax Department. For additional information applicants may contact local office of Income Tax Department or call Aaykar Sampark Kendra on 0124-2438000.

International Ao Code for pan card apply

| Area Code | AO Type | Range Code | AO No |

|---|---|---|---|

| DLC | C | 35 | 1 |

What is the AO code for foreign citizens?

AO code pertaining to International Taxation Directorate should be used. ii. In case the applicant is unaware about the correct AO code, then the applicant can select default international taxation AO code of Delhi Regional Computer Center (RCC) (at present DLC – C – 35 – 1).

How can I choose my AO code for PAN card without income?

The range code is determined by the Assessing Officer's jurisdictional range, which is determined by the individual's address. The Income Tax Department assigns the AO code, which can be found on the individual's PAN card. In case of AO code for no income individuals, the PAN card application is filled with no AO Code

What is the default AO code for NRI PAN card?

The person who is not resident in India as per the Income Tax Act should select one of the AO code from the below mentioned list. If you are unaware about the AO Code applicable to you, you may select default AO Code(DLC-C-35-1) below as your AO Code.

How to Apply for an NRI PAN card?

- Visit the website of UTIITSL or Protean and select the option "New PAN for Indian Citizens (Form 49A)".

- Fill in the online application form with your name, birth date, address, contact number, and email ID. ...

- Upload the necessary scanned documents.

0 Comments

Post a Comment